Calculate compound interest calculator

Its better understood in comparison with the concept of simple interest. R is the nominal annual interest.

How To Calculate Compound Interest Derivation And Example With Solutions Compound Interest Calculator Understanding

Daily compound interest is calculated using a simplified version of the formula for compound interest.

. N represents the number of periods. FV represents the future value of the investment. FV represents the future value of the investment.

FV PV x 1 in where. Note These formulas assume that the deposits payments are made at the end of each compound period. Total Value 206103 Total Interest 106103.

For example you deposited 1000 on a bank at 3 for a year. It is the basis of everything from a personal savings plan to the long term growth of the stock market. This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade.

The compound interest calculator lets you see how your money can grow using interest compounding. It is the difference between amount and principal. Calculate interest compounding annually for year one.

There are a few ways to calculate compound interest. We start with A which is your investment horizon or goal. N represents the number of periods.

Our calculator provides a simple solution to address that difficulty. Account for interest rates and break down payments in an easy to use amortization schedule. Now lets say you deposited the same amount of money.

Compound interest means that as your interest is earned the interest goes back into the account and you begin earning or paying interest on top of interest. To get the rate which is the period rate we use the annual rate periods or C6C8. Treasury savings bonds pay out interest each year based on their interest rate and current value.

As a simple example if you deposit 100 at 5 interest per year then at the end of one year you will earn 5 interest. The number of years t you have to. However those who want a deeper understanding of how the calculations work can refer to the formulas below.

Assume that you own a 1000 6 savings bond issued by the US Treasury. A t A 0 1 r n. Subtract the initial balance if you want to know the total interest earned.

In the formula A represents the final amount in the account after t years compounded n times at interest rate r. According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember that. A n is the amount after n years future value.

To calculate compound interest we need to know the amount and principal. Based on Principal Amount of 1000 at an interest rate of 75 over 10 years. A 0 is the initial amount present value.

How to calculate compound interest. Test your knowledge of compound interest and more. Calculate compound interest in JavaScript - Compound Interest FormulaCompound interest is calculated using the following formula CI P1 Rn nt PH.

If you prefer investing money rather than time in figuring out how to calculate compound interest in Excel online compound interest calculators may come in handy. Use this interactive tool to calculate compound interest learn more about how you can benefit from it and see how your money could grow over time. Some of its applications are.

PV represents the present value of the investment. Compound Interest Formula. The FV function can calculate compound interest and return the future value of an investment.

To begin your calculation take your daily interest. Compound interest is when youre able to reinvest the interest instead of paying it out. We provide answers to your compound interest calculations and show you the steps to find the answer.

The calculation of compound interest can involve complicated formulas. How to calculate daily compound interest. This flexibility allows you to calculate and compare the expected interest earnings on various investment scenarios so that you know if an 8 return compounded daily is better than a 9 return compounded annually.

The above calculator compounds interest monthly after each deposit is made. Check out how time can help you grow your money. By using the Compound Interest Calculator you can compare two completely different investments.

Calculate compound interest on an investment 401K or savings account with annual quarterly daily or continuous compounding. Understand the meaning of compound interest. To configure the function we need to provide a rate the number of periods the periodic payment the present value.

However it is important to. I represents the rate of interest earned each period. Compound interest is a great thing when you are earning it.

The above calculator compounds interest biweekly after each deposit is made. To calculate compound interest we use this formula. If you are curious to try this advanced compound interest calculator for Excel to compute your savings you can download it at the end of this post.

Use our free mortgage calculator to estimate your monthly mortgage payments. Compound interest is calculated using the compound interest formula. Compound interest calculator online.

I represents the rate of interest earned each period. The loan amount P or principal which is the home-purchase price plus any other charges minus the down payment. In other words the results of what you can achieve through the magic of.

PV represents the present value of the investment. Compound interest calculators online. Interest paid in year 1 would be 60 1000 multiplied by 6.

After a year your money will grow from 1000 to 1030Your initial deposit earned 30 as interest. But sometimes its helpful to see the moving. The easiest way is to have an online calculator do the math for you.

Published Tue Feb 4 2020 1122 AM EST Updated Wed Sep 8 2021 504 PM EDT. The annual interest rate r on the loan but beware that this is not necessarily the APR because the mortgage is paid monthly not annually and that creates a slight difference between the APR and the interest rate. Investing for Retirement Read our Investor Bulletin to learn about 403b and 457b retirement savings plans and how to make informed decisions when investing for retirement.

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. To calculate compound interest we use this formula. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods.

To calculate compound interest use the formula below. The basic formula for compound interest is as follows. The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a year m raised to the power of m times n.

Compound interest finds its usage in most of the transactions in the banking and finance sectors and other areas. FV PV x 1 in where. Compound interest is when a bank pays interest on both the principal the original amount of moneyand the interest an account has already earned.

Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

How To Calculate Compound Interest 15 Steps With Pictures Compound Interest Interest Calculator Simple Interest

Interest Earned On Savings Money Market Account Savings Calculator Money Market

How To Calculate Compound Interest Derivation And Example With Solutions Compound Interest Calculator Understanding

Calculating Simple And Compound Interest Compound Interest Simple Interest Pemdas

Free Online Compound Interest Calculator At Www Investingcalc Interest Calculator Financial Calculators Investing Money

How To Find Compound Interest How To Calculate Compound Interest Using Formula Youtube Math Videos Compound Interest Compounds

Compound Interest Formulas Calculator Interest Calculator Compound Interest Compound Interest Math

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Finance Money Quotes

Calculate Compound Interest In Excel Personal Finance Lessons Excel Calculator

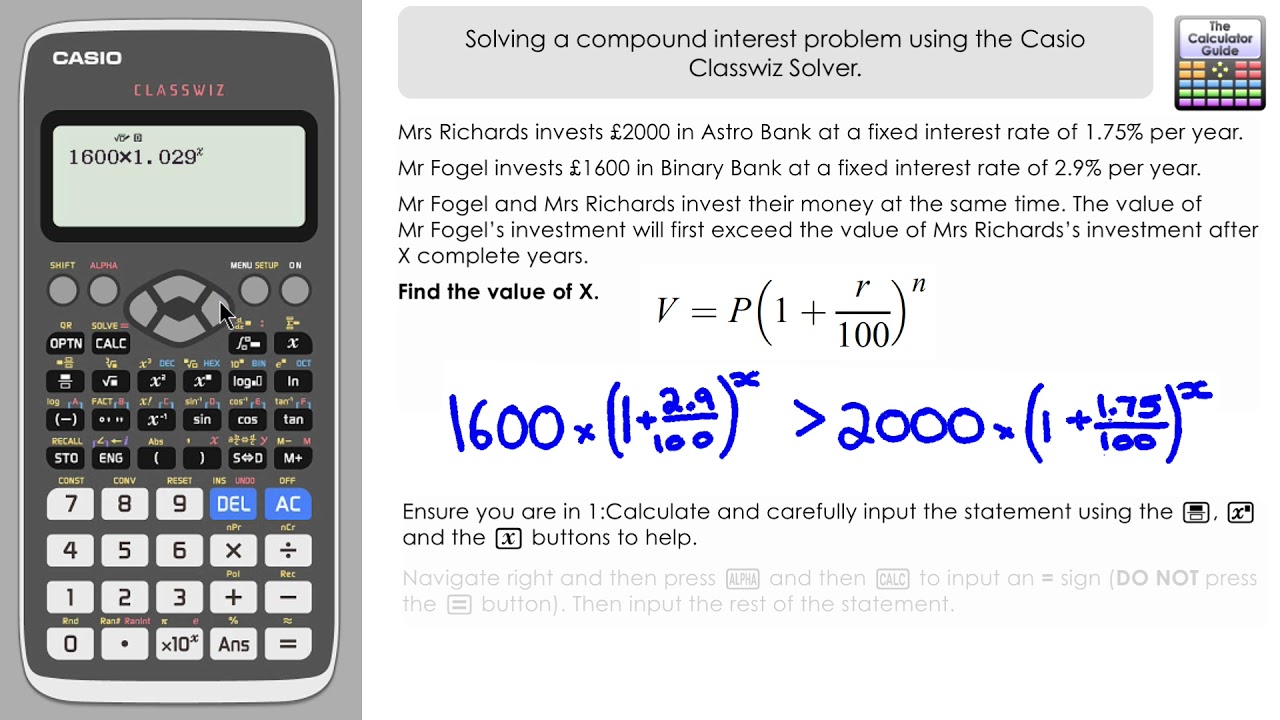

Compound Interest Problem Solving On Casio Classwiz Calculator Fx 991ex Calculator Problem Solving Solving

Formula For How To Calculate Compound Interest Interest Calculator Compound Interest Math Formulas

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

Compound Interest Formula Explained Compound Interest Compound Interest Investments Math Methods

Use This Free Compound Interest Calculation Tool To Calculate Interest And Growth On Your Interest Calculator Square Footage Calculator Square Foot Calculator

Compound Interest Calculating Tool Compound Interest Interest Calculator Compounds

Compound Interest Calculator Interest Calculator Compound Interest Investing Money

Much Money You Will Find In Your Bank Account At The End Of 3 Years Simply Copy The Same Formula Compound Interest Excel Formula Interest Calculator